Articles

See All

VISION MARINE (VMAR-NASD) WILL BE THE TESLA OF THE WATERWAYS

I see Vision Marine (VMAR-NASD; $4.90) as the TESLA of electric boating.

Boat engines around the world WILL go electric. They must, and they are. This is the bottom edge of what I see as a very thick wedge. Where Tesla was 12 years ago, Vision Marine is now. Except that VMAR only has 9.5 million shares out, and management/board own just over 30%!

The world needs this product. Marine ICE engines pollute almost 2.5X more than cars. Progressive US states and European countries are already starting to legislate the end of ICE engines on the water–and setting a huge growth curve for marine engines.

Investors DREAM of these kinds of scenarios–a proprietary technology at the forefront of a global sector about to get electrified. They have millions in the bank and the industry is already rallying around them.

VMAR’s 180 hp electric powertrain boats are selling NOW–into the sweet spot of the US$17 billion boating market–the 16-26 foot powerboat.

These engines are SO quiet—almost silent. They’re zero-emission. You can fill them up for $5 of electricity–with standard marine electrical hook up–and boat for hours.

No competitor is even close..to the power and fun VMAR gives boaters. That’s why everyone in the North America boating industry–engine AND boat manufacturers–are talking to Vision Marine CEO/Founder Alex Mongeon.

The first one to sign on last year was Beneteau, a billion-dollar-boat-company out of France. They are already ordering engines from Vision Marine for one of their models–out of many that they have. Beneteau has committed to have ALL their boats be electric by 2030.

I think the timing is perfect for this company. Mongeon and CTO ll the R&D and certification is done.

They have solid relationships with the big boat makers–effectively docking the competition. They have mass manufacturing facilities–ready to go–in North America with US$3 billion market cap Linamar (LNR-TSX;$60). They can make 18,000 VMAR powertrains a year. Everything is in place for HUGE growth.

This US$45 million market cap company has multi-billion dollar partners–a huge competitive moat–in a US$17 billion market–growing at 13% CAGR for the last decade. The industry wants the product, and doesn’t see anyone else who can provide it.

These relationships with boat makers are crucial, and shows that Vision Marine is NOT a boating company–they see their electric powertrain driving all kinds of boats from many manufacturers.

Understand that Mongeon and his team have spent THOUSANDS of hours of collaborating with the engineers of these boating companies, providing version after version for testing. They are in active discussions with FIVE of the big boat companies–only Beneteau has signed so far–but no names can be released until those contracts are signed.

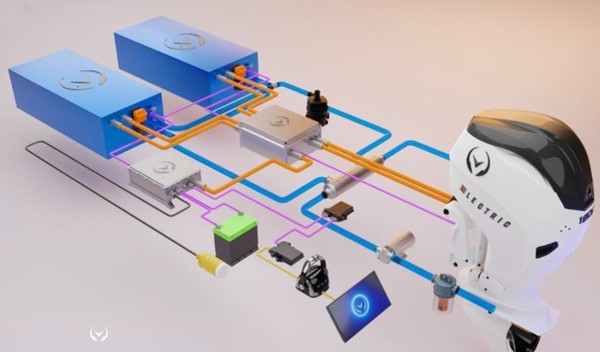

This collaboration is NOT something any new group can duplicate easily. You must have all the battery storage technology set, control the engine temperature, use high voltage power–so many specialized marine functions that cars don’t have to worry about. Nobody else is at the table with all these boat makers because nobody else has the technology.

With a proven product and established relationships with all the big guys–Vision Marine is now in a GREAT spot.

I asked Mongeon when these big boat company executives turn from skepticism into enthusiastic:

“Right after the first prototype. We work with them all, building a 3D model together. Then once they feel confident, they give us the boat to outfit, and test for a couple months.

“Then they come play with their boat under our watch. This is where they believe it. Not they are part of it, they’re driving it, and they’re smiling.

“I tell them–next time, you’re building it, we’ll be looking after you, we’ll be supporting you in your factory.

That’s what we do now with Beneteau.”

This is quite different–and easier–than Tesla ever had it. They had to fight tooth and nail against everyone for every bit of market share they ever got.

At a US$45 million market cap with only 9.5 million shares out, VMAR gives investors HUGE upside.

They don’t need to get to Tesla’s $1 trillion market cap to make investors a lot of money.

Sales of 1,000 engines/powertrains gets Vision Marine to $100 million revenue and US$3 in EPS. That is not a huge leap, given the number of multi-billion dollar boat makers they’re dealing with.

Not to mention–I haven’t talked about any government incentives that are bound to follow suit to be akin to the automotive industry.

One more thing before I move on from OEMs–VMAR is also in advanced stage talks–going on for 18 months–with pontoon boat makers–the big party boats that go out on inland waters.

Their E-Motion powertrain is perfect for this market. They’re three versions in and are nearing a commercial product here. It could provide a big catalyst to the future–60,000 pontoon boats are sold annually! Again–they will all go electric. They have to. They will. And there’s no one else to get them there.

ANOTHER LUCRATIVE CHANNEL TO MARKET

In the coming months and quarters, the tsunami of revenue will be from OEM deals with pontoon and big boat companies like Beneteau as the global marine industry goes 100% electric.

But the VERY low cost of maintaining an electric boat makes for another compelling revenue model, that Vision Marine has already proved out.

Bloomberg estimates that it costs ~10% of the cost of the boat every year just to maintain the average boat.

The beauty of electric motors is there are WAY less moving parts–no alternator, fuel injectors, transmission, filters, belts, hoses. Maintenance costs for electric motors are estimated to be 1/3rd than ICE engines.

That low-cost simplicity makes a rental model highly profitable. Vision Marine bought an electric boat rental company in 2021, and stocked it with 35 Vision Marine boats.

It’s a simple lease model, allowing resorts and marinas to rent these electric boats (which is great test driving/exposure to hundreds of thousands of boaters), and after two years, Vision Marine gets to sell them to the open market and replace the old leases with new ones.

Revenue runs at roughly US$4 million per year with 35% margins. There are 8000 marinas and 2000 waterfront resorts who are potential customers.

The first location proved to be such a money-maker, they’re opening a 2nd this year and are also looking into launching a franchise model in 2024.

Vision Marine obviously makes money off the franchise itself, but for the franchisees, the pull is that they can make their money back in just one year. Meanwhile, Vision Marine gets a substantial revenue share in perpetuity for licensing, merchandising and leasing.

DID YOU BUY TESLA IN 2010?

Look folks, the more I dug into this the more convinced I was. All the heavy lifting has been done here–years of building relationships with parts suppliers and large OEM customers, having all the manufacturing ready to go NOW, in North America…this company and its stock is now turn-key. It’s ready to go.

They are in advanced discussions with SEVERAL global boat makers. Everybody is talking to them. Here’s a simplified view of where they’re at in their business model:

If they had $100 million revenue today, the stock would be trading a lot higher than the $3.50 it is now.

And it’s already being adopted by the biggest boat companies.

With all these relationships now set, shareholders won’t have to wait for a decade for VMAR to build their name and brand in order to sell to customers en masse.

They have already won the race. VMAR doesn’t have to set electric speed records of 109 mph anymore. The Market knows who the winner will be here.

The path for Vision Marine will be much easier than it was for Tesla.

I’m a growth investor. I see a proprietary technology at the forefront of a global sector about to get electrified–don’t we dream of these kinds scenarios?

Vision Marine has reviewed and sponsored this article. The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any securities of a corporation or entity, including U.S. Traded Securities or U.S. Quoted Securities, in the United States or to U.S. Persons. Securities may not be offered or sold in the United States except in compliance with the registration requirements of the Securities Act and applicable U.S. state securities laws or pursuant to an exemption therefrom. Any public offering of securities in the United States may only be made by means of a prospectus containing detailed information about the corporation or entity and its management as well as financial statements. No securities regulatory authority in the United States has either approved or disapproved of the contents of any newsletter.